The game we play changes weekly it seems. Some of the best options from last month are quickly dying, and other new options are filling in. I’ve been out of the country for two+ weeks, and have been happy to see debit cards which were not working before I left come back from the dead upon my return.

I’m constantly looking for more ways to earn miles. I guess you could say I love miles. I did name the blog Milenomics afterall 😉 Today I’ll go over a complex strategy I’m going to be using for the rest of the year. In doing so I’ll highlight a few key things you too should always keep in mind.

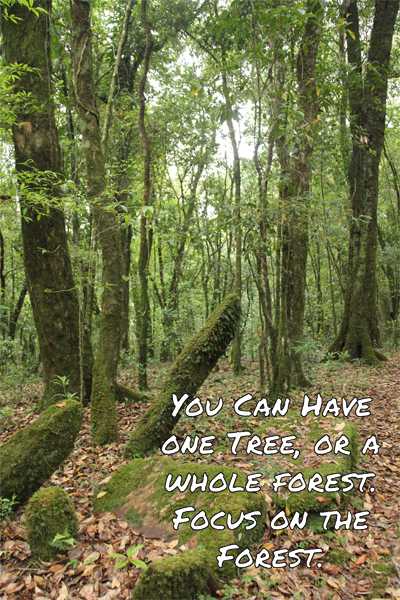

A Strong Tree, or A Whole Forest?

One thing I want to challenge you to do is to step out, and work on multiple sources for miles. Doing one thing is great, and doing it consistently can be a great way to drive your costs down. However when you stick to just one manufacturing line you end up getting to a point where earning more miles is either impossible, or becomes much more expensive.

Never forget: Miles can be earned in places you’d least expect them. Continuing to do the same thing over and over means you can miss out on ways to earn miles right in front of your face. You can’t see the forest for the tress.

Continuing the tree analogy: think of any way you earn miles as a single tree. You want to nurture all of those trees, and grow them to their potential. Whenever possible, you want to plant new trees. This is because opportunities (like trees) often get chopped down. Having a healthy forest means one or two trees lost won’t have as large an impact on your overall earning potential.

Today is the first in a two part post about ways to expand your mile earning potential in less than traditional ways. We’re not about exposing a single loophole here at Milenomics; rather we’re about finding what works the best for you, taking into consideration your travel needs, and supply and demand for miles.

Even “Useless” Cards Can Have Use.

I’m sure you have those cards which you signed up for to earn a large bonus, and have since decided are not worth keeping. Maybe it’s the Chase Sapphire Preferred or Barclay Arrivals World Mastercard. Or maybe when you were much younger you applied for a few cards and never got around to closing them.

Whatever the card I’m sure you’ve considered closing that card at some point. Don’t do it! Instead of closing cards we should be pushing for an annual fee waiver, applying for a new card and moving the credit line over or downgrading to a fee-free version of a card. These three techniques make up the 11-month itch, How to Avoid Annual Fees.

Just one of the many reasons I advocate never closing a card is that you never know when they’ll be useful in saving you money.

As an example lets take Capital One. I’m not the biggest Capital One fan in the world–but I still have a Cap1 card. I’ve saved hundreds by using their car rental portal whenever it is the cheapest. By using 11-Month itch techniques I’ve avoided an annual fee while keeping this [sometimes] useful card open.

Another example of this: there’s an offer right now for $25 back on $25 spent with Citi wallet and a Citi Mastercard. Up until this year I had nothing but Citi Amex and Visa cards. But in January, as part of my 11 month itch calls I converted one Visa to a Mastercard. That card has been safely tucked in my sock drawer for the last 7 months, but it will come out and earn me a quick $25 worth of newegg for free.

I can’t recall ever advocating closing a card outright–even if the card is “useless” in your eyes the credit line alone is worth preserving. Having more available credit makes you look more credit worthy, and reduces your Credit utilization ratio. In addition you’ll never know when an opportunity might come along to use a card.

Useless, or Use Less?

For more on this way of thinking see the prior Milenomics discussion of United miles. United miles are Worth Less, but they’re not worthless.

Today I’ll outline a similar situation, where a card which seems absolutely useless has an amazing use afterall.

The card in question is this:

The Congressional Federal Credit Union Platinum Visa.

I’ll quickly recap the card’s main benefits:

$0 Annual Fee

8.5% APR (pretty good, but we know better than to carry a balance)

That’s it.

No reward structure.

No cash back.

Nothing.

Why keep this card? Well, I’ve had it for 10+ years, and it has a healthy 5 figure credit limit. With $0 annual fee why not keep it? I’ve used it once a year for a redbox rental, just to keep the account active. the $.11 in rewards I forefit using this card for a $1.31 rental is a fair price to pay. And I always assumed there might be a day that I actually need the card.

That day has finally arrived…

My Recent Strategy Relies on This Card

I’ve started to run up against some of my own personal limits in manufacturing miles, and I need to somehow exceed that limit. I have a demand for a certain miles, specifically SPG points, but I have no good way to double or triple dip in manufacturing them. I was looking to make a quick 30,000-50,000 SPG in the next 3-4 months, and the thought of losing out on a double dip has kept me up at night. Not being able to make miles on the payment of the SPG Amex seemed like an incredible waste of my time, and travel.

It pains me to leave Miles on the table like this. I’m always looking for possible ways to decrease my costs to manufacture. I lost the ability to double dip on SPG points when Amex no longer was allowed to be paid at certain bill payment outlets.

To get around this I’ve thought about doing a Utep Two-step: Pay the SPG Amex with a Balance Transfer to a Visa/MC and then pay that off with Bill Pay.

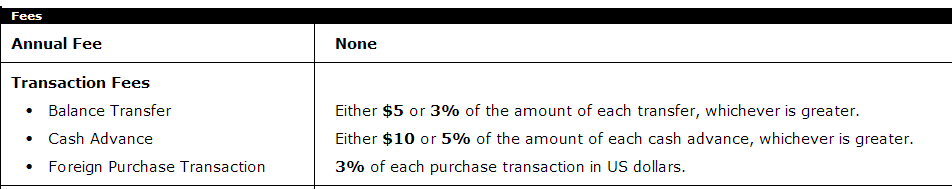

The benefits of this are that I can make one quick payment and earn a chunk of DL or AA miles. The negatives are usually the costs; Balance transfers can be pricey. I recently received a “0% Balance Transfer” offer from Citi. This offer had a 3% fee upfront. I’m not sure how something can be advertised as 0% and a 3% BT can be tacked on upfront.

For the purpose of this double dip I don’t need the BT APR to be at 0%, the line of credit will be paid off the next day, so the 0% APR doesn’t matter as much as the origination “fee” does.

If the origination was 3% I’d be paying $0.03 in fixed costs per DL/AA mile I generate this way. Add in my time and travel, and there’s no way I’d go for something like that. In fact even at 1% BT fee I’d probably pass. What I was in search of was a 0% BT fee. Something where my only costs would be a day or two worth of interest (Maybe $3 on a $5,000 BT).

Warning:Balance Transfers start to incur interest charges immediately, not after a bill has been generated and a grace period has passed. Because of this, use extreme caution in employing Balance Transfer. Know exactly what you’re doing, and try smaller amounts before going nuts with a $10k+ BT.

With a 0% BT fee and only a day or two worth of interest I could pay off this $5,000 and incur no more than approximately $4.88 in fixed costs. And I will earn 5,000 miles for the purchase.

In researching the cards I have which are not Amex cards for a good Balance transfer deal (integral to this double dip) I just happened to look at the above CFCU Platinum card. The card’s balance transfer option is ridiculously good:

This isn’t a promotion, or a special one time deal. This is the every day, all year BT offer for this card. This was exactly the sort of Balance Transfer I needed, and it was sitting in my sock drawer for the past 10 years!

With this in hand I now needed to test the efficacy of the strategy on a small scale. First, I needed to be able to pay this card off as a bill payment. This test was completed without any issues. Secondly I needed to be able to generate a Balance transfer of a large amount. Again no problem, I spoke with the CU and my entire credit limit was available for a balance transfer.

No Risk, No Reward

In writing this post I would be remiss if I didn’t go over some of the specific risks involved in this type of churn. The biggest risk is account closure, or AA. My Congressional FCU CC could easily be shut down for too many “in and out” transactions. The purpose of a 0% BT fee is not to use it over, and over, and over and pay it off daily.

In addition Suntrust could hate on me, and shut me down again. For me the threat of another shutdown is actually what is pushing me to pursue this manufacturing line; I need the extra capacity and have been paying my Amex bills (like a sucker) without earning anything since Walmart changed their system to no longer allow Amex payments (exceptions do exist).

Is this type of strategy for you? Maybe. Keep an eye on BT offers you receive. If you get one that is low enough you might be able to leverage this type of two-step to lower your manufacturing costs.

This deal Almost All Miles Are Local

At some point in the past I’ve mentioned the fact that All miles are local; by this I mean: what works for one person in a geographical area won’t necessarily work somewhere else. The combination of stores, employees and policies need to be right for you to replicate exactly what others do. In addition, as today’s post shows you need the right combination of cards as well.

Sometimes a deal is great, and just isn’t open to you as a resident of a different state. Other times a product is open to a limited group (such as USAA, or the CFCU card I’m writing about today). That doesn’t mean you should give up hope. It just means you need to find your own best practices.

This isn’t a deal most of us could take advantage of. Having access this specific card isn’t something most of you will have. I’m posting today instead to challenge you. Take inventory of your cards, all of them, and see if your useless cards can become a card you use less than your main cards–but still use in some way.

And today’s post will further reinforce the Milenomics core philosphy: Never Close A Credit Card outright. The exception to this rule is if you have to close one card to open a new card as part of a CCC round of applications. You never know when a card will be useful in some way.

Come back tomorrow and see how the shortest distance between two points is not always a straight line 😉

-Sam

I have never seen a Balance Transfer offer which didn’t have a fee associated with it.

Al: They do exist. The key is finding something with no fee to tap into it, and is still payable at a billpayment center. I won’t get more detailed than that–but if you’d like to discuss more feel free to email/DM on twitter.

Several times I’ve had a fee free balance transfer offer from discover. They would normally offer two possibilities: one with a balance transfer fee but a 0% apr for 12 or 18 mo, and another with no fee but a higher apr like 4%.

Yes, I have received similar offers from Discover. But the question is whether Walmart Billpay work with Discover?

It will; all day, every day.

I understand and definitely agree with a lost of the “never close a card until you absolutely need to philosophy”. But there are some occasions where I find myself in conflict. In particular, the ability to churn credit cards.

Many banks don’t allow you to get rewards on the same card twice …. UNLESS you haven’t had that card in the last ~2 years (varies by bank). If you continually keep a certain card open, you can never reap a sign up bonus on it again in the long term. Three examples that come to mind are: (1) Chase Southwest cards, (2) Chase Sapphire cards, and (3) Citi AA cards.

On all three of these, if I held on to them as long as possible, I wouldn’t have been able to go a second round on them this year (After closing first round in ~2011 or 2012).

Tom: I’ll try to go over it a bit more here in this comment. Your example is actually in line with the rule. In essence you’re only closing cards because you actually have a need to do so (churning them over and over). You should still be ready with the proper way to do close cards. As a rule I never just close a card, tear it up and walk away. My suggestion for the three cards you list would be:

Merge the credit line from the SW card into the CSP. This preserves the line of credit and will help in the future should something change (income, etc). You can then cleave off a portion of this larger line to get approvals on other Chase cards.

Downgrade the CSP to a Freedom. I’ve written extensively about how much better at earning UR the Chase Freedom is with a Ink Bold than a CSP is. You can never have too many Freedoms. I hate the Chase Sapphire Preferred card.

Citi AA card(s). Citi is so aggressive with their Annual fee waiver program you might earn miles to keep the card open (1k a month x 16 months). You could downgrade to a fee free version, or apply for a new Citi AA card in a different brand (Visa, MC, Amex) get the new bonus, and merge the credit lines.

But in all I’m glad you at least consider these issues, and weigh the options of keeping the card vs. churning the card. You’re an active consumer, rather than a passive one, and I wish more were like you. Simply keeping a card you never use and paying the annual fee is the mindset we’re trying to change here.

Also worth noting the extra 1k a month for 16 months is a neat trick from Citi as when you get to the 12th month the annual fee comes up again and then you cannot get another retention offer as you still have an active one. Given this is Citi I am thinking that is accidentally clever on their part lol

Very smart, I like this idea. There are indeed several credit cards with 0 balance transfer fees. However isn’t it just easier to stick with buying money orders?

MA: It could very well be. I’m using MO almost entirely to liquidate GC’s. I find doing multiple purchases is the best way to maximize my time at WM. Load BB (up to the limits), Buy MO, and then a large Bill Payment. The total I’m earning in DL/AA miles seems to be bogged down by the volume of GC’s I’m liquidating, so this is an attempt to push past that limit. Also my trips to WM are pretty well fixed, I’ve debated adding a second shift at night to liquidate more GC’s. Doing that should free up space in the morning, but that also means more time, and at night the line can be 3x the morning.

I’m going to give this a go for a few months and see if it can help increase my volume. I have the same worry you do, that it will just be shifting things around, and no net gain will come from it. For people who are touchy about MO this is a valid strategy. In addition, for a smaller operation the ability to make a $5,000+ payment and not have to deal with depositing MO is worth something.

Hi Milenomics,

This is a side topic, I am thinking of apply for regular AA personal master card with AA executive (applied 3 month ago) still open, do you think is that possible? Some flyertalk threads saying I have to close my AA executive and wait for more than 18 months. Do you heard about this?

Thanks,

e.c.

Hi Eric. I haven’t, and wouldn’t be able to advise you with any certainty. If you decide to go for it come back and reply and let me know how it goes, I’m interested to know as well.

Thanks. Wow, that was very fast reply!

On the topic of your post: so what you tried to do here is: use credit card A to buy GC’s, and then use credit card B (no fee for BT) to transfer balance from A, finally use Bill payment to pay B with the GC’s. Right? if so, why don’t you use BP to pay A directly? Are you worried about being shutdown by credit card A?

Erie: I have two response speeds, very fast, and one week later 😉

You’re correctly describing the mechanics of the post. The reason I’m not paying card A directly is that card unable to be paid with BP. Card B is any card which can be paid with billpay, and so the BT from A to B allows a billpay to occur. MilesAbound’s comment brings up some other good things to consider, like why not just buy MOs, so be sure to read his comment as well.

I have a 6 year old Capital One card that got converted to a Venture card. No AF, but stuck forever at a $3k limit, no matter how much I begged. I’ve almost closed it several times, but it is one of my oldest open cards, so I left it in the sock drawer.

It has always had a $0 fee BT option, but with the regular APR after statement close. I’ve used this occasionally to shuffle money around for a few weeks. Well, the last time I did it in May I used the entire limit and voila! they increased it to $8k. Still not an amazing limit, but much easier to work with.

Even better, they actually gave me points for the BT (1x).

Thanks for posting your experience for thers. Points and a bump in CL, that’s an amazing use of a sock drawered card! Well done.

Speaking of sock drawered cards, my oldest card by almost 2 years is a secured card with a $500 CL. I’ve had it for 2 years longer than I’ve had my first Amex card which I got January this year. I keep it open and pay the $35 annual fee, because my average age of account would go way down if I didn’t. I should be able to get rid of it sometime in 2016.

Quick question: how large can a BP at WM? Do you use multiple GCs for 1 payment? In other words, if you want to pay 5K, do you have to do multiple BPs or just one with multiple GCs?

Thanks!

Angel, you’re limited to 4 cards, so unless you have $1k Visa debit cards the practical limit is $2,000. However adding in a mile earning debit card you could pay much higher amounts. 3x$500 and the balance of up to $7k or so could be done with the right setup.

It would be really nice if y’all date y’alls articles.. I can’t figure out for the life of me if this was written in 2012, or 4 hours ago.. And sadly that goes for all the articles I’ve read so far on this site. All other articles on other sites are dated, so I know “oh I can still do this”, ” oh that’s expired”… millionmilesecrets, thepointsguy, mileageupdate, maitais’s site, hackmytrip…. 🙁

Alex, the new theme must have broke the dates on posts. I’ll get them back ASAP and I appreciate you letting me know they were missing.

This post is from about a month ago.

your articles are super amazing lol, I just realized that ever other blog I’ve read was just to prep me for reading yours lol, and even then some of them are quite complicated :))) I have a bunch of questions, but I don’t know where to ask them! Oh, I added you to tweet :). and I don’t ever tweet… just opened an account 2 days ago, then I realized its not the best place to ask questions…

Alex: there’s also an “Email Sam” link at the top of every page. You can reach me at samsimontravel@gmail.com

Are there any debit cards that are still available that earn miles? Suntrust is dead.

I have been getting some decent AMEX $0 fee on purchases and a low 3.99% interest rate for 12 billing cycles.

I like to play the low interest BT game along with earning miles. I would like to see a list of banks/offers that have good BT offers a couple years after, not just the initial 0%’s we see.

I like the Pentagon Federal Credit Union one that is 3.99% lifetime and $0 fee. Very generous credit limit as well.

Mike: The UFB Direct AA earning Debit card is still available. It has two big drawbacks: first, it earns 1 mile per $2, not 1:1. Second, it has a daily cap of $1500 in spending, and a yearly max of 240k AA miles.

I should add that with the new updates to CheckfreePay at WM the strategy outlined in this post is now all but totally dead. Your store might have not updated yet, but mine has, and Visa is gone as a CFP payee. 🙁

Thanks for the heads up!

Still like to hear about good BT offers that exist long after initial opening offers! It’s nice to float $100k+ around at a low rate and make money on it. Time value of money!