This post was originally titled “Wells Fargo, You’ve Ruined Us All.” The reason being is that for a time Wells Fargo created a program SO good, so easily manipulated, and so valuable, that it actually created its own economy around it.

—

Robert’s been tearing it up here on Milenomics, with one excellent post after another on a multitude of topics. One of the more thought provoking ones (I think) is the power that the word “Free” has over people. To me there’s a SERIOUS misconception that things in this universe are “FREE!”

Today I’ll discuss what *I* think needs to be done with everything you own; Setting a floor on the value of your points and miles.

A Little History Lesson:

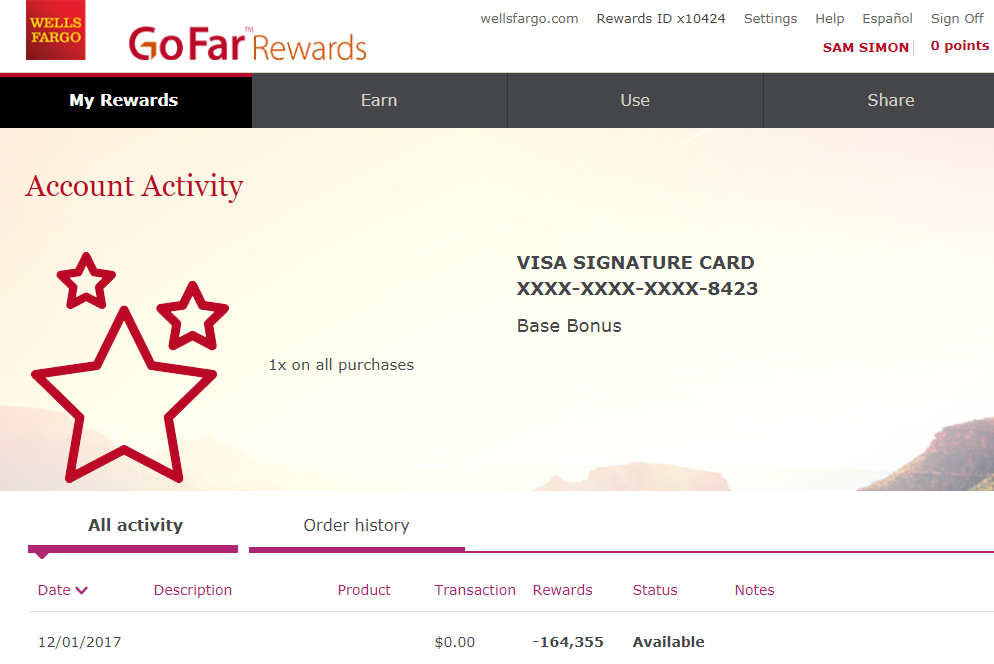

Up until the end of 2017 the undisputed king of cashback ‘points’ had to be Wells Fargo GoFar rewards. These aren’t exactly miles because they don’t transfer anywhere, but for a time it was Extremely fun (and extremely easy, RIP TIO) to manufacture these points en masse. Playing in two player (or higher) mode meant you could earn millions of these with almost no effort. Those days have gone by the wayside now, but still I think discussing these points is very important.

WF values their points at 1 cent per 1 point (1:1) if you take a statement credit. IF you book travel with those points you can then earn 1.5 cents per point. And in a twist that makes WF either the dumbest, or the most genius bank on earth, if you spend $50,000 or more on your card your points become worth 1.75 cents per point.

Yes, if you go nuts and churn the card they actually reward you with MORE value per point, not less.

Readers with a keen eye will see there’s a nice spread there, between 1 cent and 1.75 cents. But you’d need to travel a ton, and do so quickly as the 1.75 uplift doesn’t last forever. And If you don’t care to travel at all your stuck taking those points as 1:1 statement credits. By doing so you’re ‘throwing away’ .75cents per point in travel bookings. (you’re not, but let’s argue that you are).

Enter: Geniuses

Entrepreneurs figured out how to transfer and pool large amounts of these, and bought them from people who could care less about travel. Let’s say they paid you 1.35 cents per point. T Great you’re thinking, but now what… these guys need to travel an awful lot or they’re sitting on 1.00 points they paid 1.35 for.

Squeeze those fractions of pennies further and you can find someone (or a lot of someones) who wants to buy travel and give them a 10-15% discount. Let’s use round numbers to illustrate this entire ‘shadow economy.”

- 100,000 Go Far Rewards points:

- @1cpp = $1,000

- @1.5cpp = $1,500 in travel

- @1.75cpp = $1,750 in travel

- @1.35cpp = $1,350 sold to a 3rd party

- $1,750 in travel, discounted 12.5% = $1,531

The uplift to 1.35 is a 35% increase for the card holder who won’t fly enough to use the full 1.75x. The spread to the broker is a profit of $181 on an outlay of $1350, or just about 13%. Now add a zero. 1,000,000 GoFar Rewards = $1810. Now add 2 zero’s, 10million points=$18,100. Keep going….

35% more money in the cardholder’s pocket. 13% more in the broker’s pocket. Win:Win. GoFar indeed.

This activity dramatically changed how I now see my points/miles. There’s a peak value that *someone* can attain (maybe even me), call it a ceiling. Then there’s a minimum amount I’d get paid out if I was shut down, or a minimum I can cash out as statement credits, call that the floor. When the difference between the two is great I’ll hold the mile, when it is low enough I’ll consider cashing out.

When the spread between my holding the miles for future travel and cashing out was 1cpp/1.5cpp I’d hold and book travel. But at 1.35/1.5 I’m squeezing pennies and risking shutdown and forfeiture along the way. I’m dumping at 1.35 and call the .15 I gave up point insurance. Long time readers know that I like to insulate myself from any chance of shutdown, through things like a financial firewall.

NOT HOLDING POINTS AT ALL IS THE ULTIMATE HEDGE AGAINST A SHUTDOWN.

Bolding, italicizing and all upcase because I think this point doesn’t get enough play. The $1350 in my pocket (well, retirement account) has a near $0 risk of complete loss. Holding your own personal 1Million GoFar Rewards has the potential of being wiped out, especially when you’re dealing with the most incompetent bank on earth. (My opinion, but I’d love to hear you argue against me).

When the spread between what I *think* they’re worth and what someone is going to pay me for them gets close enough I sell out. Yep. I’m a total sell-out. And maybe you should be too?

What About Other Programs?

UR has a clean floor on the value of points and runs a tight ship. You can get 1cpp as a credit, 1.25/1.5 as travel (CSP/CSR) or some other value if you transfer to another program. Maximum for me is 3-4cpp, and minimum 1cpp.

Robert’s post covers this much more in depth. Transfers are tighter, earning is relatively easy. There’s always the 1:1 redemption of course, but for me I stick with using UR at 1.25/1.5 or or for transfers to airlines for flights (2cpp+). There’s too much potential upside and the spread between my floor and my ceiling is too great to *not* hold these.

I think Robert’s post above helps a lot in setting a floor for all the major flexible points out there right now. But Where do you set a floor for something like American Airlines miles? They can’t easily be converted to cash yet there are lists all around that show you what those points ‘should’ be worth. There’s no escape hatch on these points like a statement credit, so the real floor on these is 0.0, but my floor is a little higher, 1.5 cents.

Why such an arbatrary amount? Because I’ve had good luck selling at this amount. I’ve had to line up the right ticket for the right person (22,500 or so miles +fees for a $375 ticket). I also don’t hold a ton of these, so I tend to earn them as I need them and cash them out along the way.

Opportunity Cost is Almost Pointless Here

The idea that your points are worth 2cpp because you could have used a 2% cashback card is nice; but that doesn’t mean anything if there are no good ways to *use* those points at 2cpp+. For sure that should stop you from continuing to manufacture those points, but there are an awful lot of places where you manufacture a ton of miles for almost no cost. Sign up bonuses are an example of this. You can’t apply for an AA credit card and get 50,000 miles and say to yourself “Well, I could have had $1,000 instead; no such choice was given to you. So you get 50,000 miles and eat up one of your 5/24 spots.

If someone came to you and said “hey I’ll take those 50,000 AA miles for $725, would you say no? I wouldn’t.

In the above opportunity cost example there’s a twist–sometimes you are given a chance at picking between sign ups. You’re at 4/24 for example. Your next application with Chase (because if you’re at 4/24 and you don’t apply for a chase card I give up) should be for the best possible Chase card you can get. If it isn’t you’re literally trading X for Y, and in doing so you’re saying to yourself X ≥ Y. If I was 4/24 the best card I’d get would be the Ink Preferred 80k offer. Any other card offer subject to 5/24 ‘costs’ me 80k UR in return for its sign up bonus.

Note:Incremental cost is much more important in this game. Can you manufacture more Bipennies? If you have a bunch of 2% cards like myself (6) and you’re not maxing them out monthly then, and only then can you point to 2c as opportunity cost.

Real World Example

Yet another new post from Robert here has working links for WF business cards. There seems to be a lack of information as to whether choosing the card that earns points (Vs. cashback) will still net you the $500 bonus. There is wording that says you must take the cash back to earn the bonus. BUT this is WF, so no one knows how they’d respond if you took the points option. And if WF allows transfers those points could be worth much more than $500 towards travel (or to a broker paying 1.35).

When confronted with these choices I ran the numbers for a floor/ceiling: $500 vs. a possible $675. With such a low spread and a possibility of no bonus, I took the cash back option when I applied, would you have done the same?

What did Tio allow that Plastiq didn’t?

Lower cost, virtually no limit one number of or amount of payments. The real killer app was that they sent the payment to WF that day and freed your credit line up for more purchases.