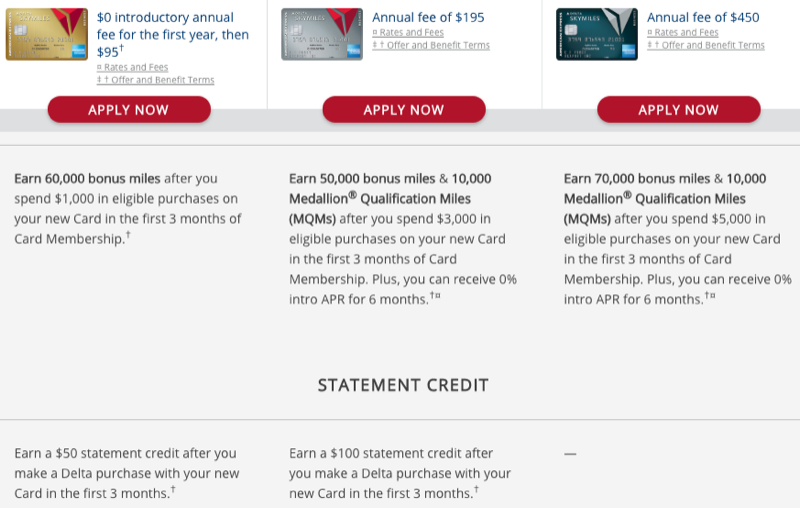

Targeted Amex Delta offers are being sent out via email:

- Gold: $95 fee waived the first year, 60,000 + $50 Delta statement credit

- Platinum: $195 fee not waived the first year, 50,000 miles + 10,000 MQMs + $100 Delta statement credit

- Reserve: $450 annual fee not waived the first year, 70,000 miles + 10,000 MQMs

The same offers are also available on business versions of the cards.

The best thing about these offers [if you’re targeted] is that they do not contain language excluding cardholders who have or have had the products. Be sure to check your offer to confirm that’s the case by searching for the string “have had” on the offer terms page.

To see if you’re targeted go here and enter your Delta SkyMiles number and last name:

https://www.deltaamexcard.com/offer/a01f-em-sept-18-biz

You may have received an email with the subject line: “Special Offer: Earn 60,000 Bonus Miles And More”.

Targted Amex Delta Offers (Personal)

Targeted Amex Delta Offers (Business, identical to the Personal offers)

How to Play It

SkyMiles may get a bad rap, but I keep finding ways to use them.

If targeted, these offers provide a way to get the signup bonus for cards you’ve had in the past. The Gold and Reserve in particular are at or near all-time highs. The Platinum offer lags current and historical highs.

There’s always a chance that even if targeted, Amex might display a pop-up indicating you’re not eligible for the signup bonus.

And keep in mind that most people are limited to 5 active Amex credit cards. If you apply for a 6th and the application goes pending, call them. They’ll likely ask you to close one of your other Amex credit cards to enable approval.

If you haven’t had these cards you’d be better off using a referral link especially if you can refer your spouse or self-refer. I cover those approaches in more detail in this post.

If you weren’t targeted, I don’t see a way to make use of these offers.

It’s great to see offers like this that skirt Amex’s lifetime restrictions. It really does look like Amex is Crushing Chase lately .

I think the offer my husband got this morning may be this. But this post by MIleNerd:

http://www.milenerd.com/getting-the-shaft-amex-edition/

makes me think that it may not be as easy as it appears. Do you have any data points that Amex does indeed give the bonus and MileNerd was the outlier – or is his experience more typical?

Thanks!

I personally think his experience was an outlier.

This newish language on their offer terms hints at what they might be looking for:

“If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit the welcome offer to, we may freeze the welcome offer credited to, or we may take away the welcome offer from your account. We may also cancel this Card account and other Card accounts you may have with us.”

Got an error message attempting to login via link.

If it’s “PLEASE VERIFY THE INFORMATION YOU ENTERED IS CORRECT AND TRY AGAIN.” you’re not targeted 🙁

Thank you for clarifying. 🙂

I got this card in June 2017 and cancelled in May 2018. I received the targeted e-mail and decided what the hay so I applied. It originally went pending but about 20 minutes later I was approved. The message about being ineligible for the bonus never came up. What do you think are the chances of getting the 60,000 points?

I think your chances are good, but of course my opinion doesn’t count.

Good job being the datapoint you want to see. Let us know how it goes?