We’re not yet at the return of the traditional app-o-rama yet–but today I want to introduce the idea of using your float to earn additional money. This post is risky business–mostly because the effect on your credit score, the possibility of messing up and owing interest on your credit cards, and the chance of malfunction with respect to your bank accounts as well.

Disclaimer: I’m not a financial planner, this is not financial advice. This is actually probably BAD advice for almost everyone reading it.

Chase Sapphire Banking Overview

I’m not going to use this post to discuss the merits of Chase Sapphire Banking. I think that Chase as a physical bank is competent (as in they take deposits and allow withdrawals, offer loans and other banking services). I don’t think they’re competitive with many/any other online banks.

With that said here are the main benefits Chase is touting with Sapphire Banking and using Chase credit cards canada:

These are nice features, but they’re certainly not unique. You can duplicate these with a Schwab checking account for no ATM Fees and a Robinhood trading account as an answer to “You Invest” (one of the dumbest names ever for a trading platform). So this isn’t a play for someone who’s into optimizing their bank accounts. Chase’s play seems to be banking on the Sapphire name to entice people who want to set it and forget it with a physical bank.

That’s not me, so I’m looking at this from a pure bonus and downgrade play.

The Cost of 60,000 UR is not $0

Of critical importance is that retirement accounts don’t count towards the minimum deposit–and you need to bring $75k of new funds. That means you either need to transfer in a brokerage account and use “You Invest” (really, please, change this name) or transfer over an emergency savings account. I’ll talk about a brokerage account a little later, for now, given that there are a number of accounts earning 2.0% or greater let’s look first at what we’re giving up by parking $75k in Chase for 3 months.

Let’s say you leave $75k in an account earning 2.5% for those 3 months. You’d earn:

$75,000 x .025/4 = $468.75.

That’s taxable, but Chase is saying the 60k UR may be taxable as well.

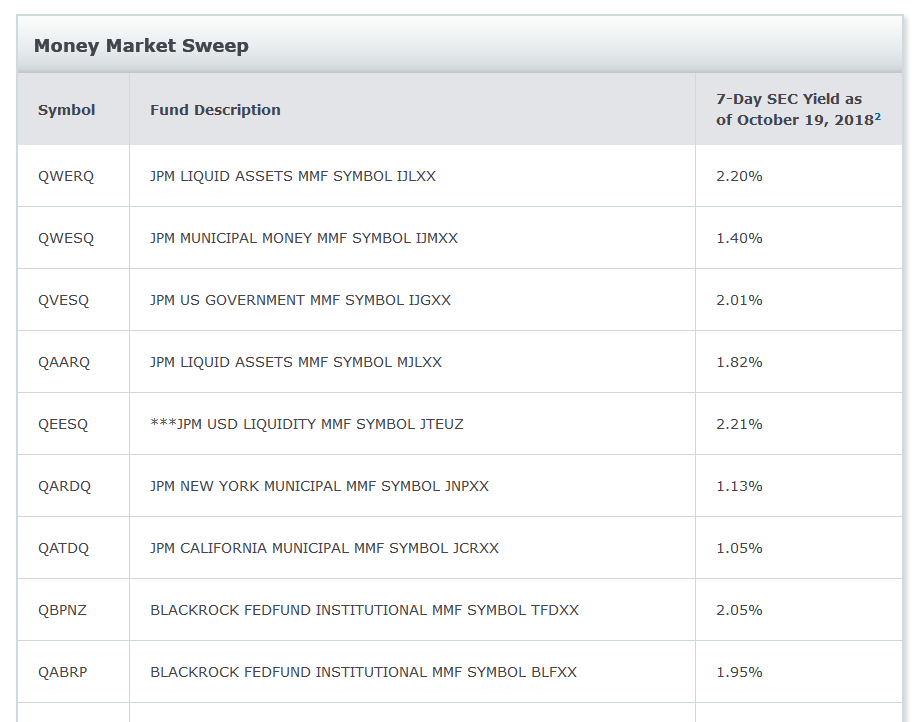

The next step to analyze is what can we earn with Chase on this money? We might be able to put the $75k into a money market fund. That’s not no risk–but is very low risk, though every bull market except the great recession these funds have never lost money for their investors. The one and only time it appeared there would be a loss on MMF (2008) Treasury stepped in and backstopped the value to $1 NAV. (source)

If you want to stick with totally secure type of accounts you’d limited to Chase’s savings rate (currently .01%, or 1/250th of the currently best available rate). So we’ll call that a measly $1.88 for three months. Doing a quick subtraction from the 2.5% we’d be able to earn elsewhere:

- If you’re not comfortable with the risk associated with a money market fund you’re paying $466.87 for 60,000 UR, or .78¢ per UR ($0.0078).

- And if you’re going to go with one of the MMF accounts above and earning around 1.5% you’re reducing the cost of those UR by $466.75 – $328.12, or a net ‘cost’ of $138.63, or .23¢ per UR.

At .78¢ per UR I’m leery. The taxes on the 60,000 UR could mean that a cash out at 1:1 is almost a wash. But at the lower cost of .23¢ per this is a decent offer, and on par with good opportunities to earn UR though gift card purchase and liquidations.

Now that we’ve outlined a way to soften the blow to your savings you can decide whether to take up this offer or not. For some of you however the hard part becomes where to get $75,000 of new money from?

You could transfer in a brokerage account with a healthy balance and call it a day. Unfortunately I have no experience with “You Invest” (Again, dumb name) so I can’t say if you’re trades will be executed promptly, or if that would be a good idea or not. I do know that losses that would take your account balance below $75,000 would disqualify you from the bonus–so build in a cushion if need be. Correction: It appears losses don’t impact the bonus. H/T to @tallfinancier.

Instead I want to outline a way to create the $75,000 you’ll need for 3 months here instead.

Revolving $75,000 for 90 days

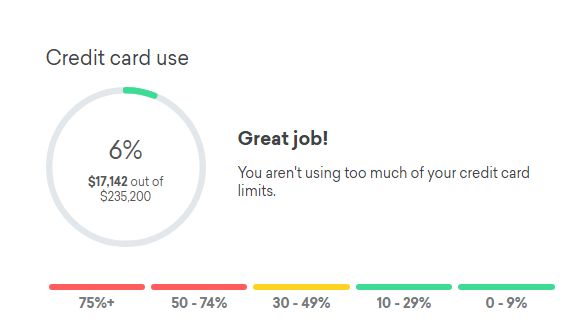

I logged into Credit Karma the other day to keep tabs on a dispute I’ve been dealing with. In doing so I was greeted with the following:

My wife and I never apply for joint accounts–she’s got a little over half as much available credit. This means that together we’re looking at $400,000 in usable credit lines. There’s not really a need for this much credit, except for rainy days and times like the upcoming higher interest rates.

What this allows me to do is take my credit lines, divide them in half ($117,600) and know that if I charged that amount each month, I could then float that, and charge it again the next month paying down the balance on the cards while incurring a new $117,600 in charges. You’ve then captured $117,600 in cash for investing in…anything. This is a 100% leveraged investment–so losses incurred are REAL and could bankrupt you (and maybe get you in even more trouble). But, given a safe enough investment, like a savings account, the gains are real as well.

This is a balancing act of sorts–a tightrope walk without a net really.

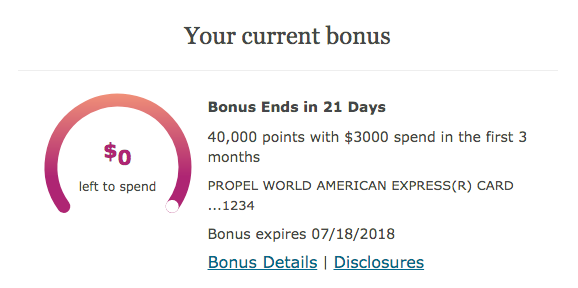

If I want to go in on this Chase offer I need to bring about $50,000 in float to the table. That means buying, liquidating, depositing, and transferring about $50,000 in Money orders a month, while letting my statements cut at 50% utilization.

- Does that seem like an insane volume to you? If so, stop reading this post, close the browser and don’t attempt this.

- Does that sounds like a normal few days’ work to you? Then consider chasing a return on that float. This post was originally conceived as a way to do the Ally 1% bonus ($1k for parking $100,000 for 3 months, plus interest of $475 *dead now*). The technique works for any interest bearing or bonus level account, including the above Chase Sapphire Checking 60,000 point bonus offer.

This Will Destroy Your Credit Score

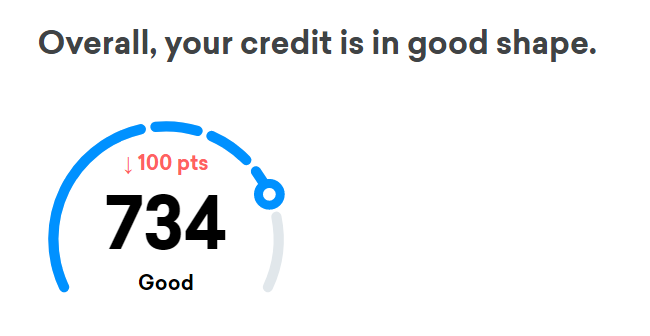

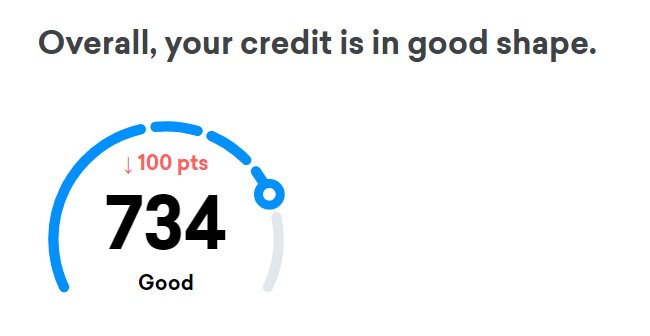

In the short term going from 3-5% utilization to 50% utilization on cards will probably drop your credit score 100+ points.

Â

That could mean not getting approved for new cards–a higher interest rate on purchases like cars/home. As I mentioned at the start–this is indeed risky business, and not for everyone (or maybe not for *anyone*).

Consider Changing Nothing But the Return

Even if you’re not going to go bigger than your normal float, as rates continue to rise consider how to earn interest on that float to offset some of your fees. If you’re spending $15,000 a month on giftcards (30 cards) you could earn $31.25 a month from a 2.5% interest savings account–nothing amazing–but we’re collectors of pennies after all. Would you pass up an additional $1 profit per card if it was easy to capture?

Things to consider, and like I said–not for everyone. If you’ve got a good strategy to maximize your float please consider sharing it below in the comments.

I think I heard that this particular bank account is only available to you if you are already a Chase Sapphire customer. True?

Blue: In my personal and limited experience this is true. Both my wife and I are individual Chase checking account holders. I hold a Sapphire card and she does not and only I received the targeted promotion. (Contains unique coupon code)

That is a whole HEAP of credit wowzers

Thank Sam, this made me miss Fatwallet Finance.

What you’re describing is a variant on AORs that were pretty common in the late 90’s – early 2000’s. Instead of going CC->GC->MO->Bank you’d just deposit the balance transfer checks (which often charged you 0% interest for 6, 12, 15 months plus 0-1% fee). Of course nowadays people care more about the points, and back then you couldn’t yet do GC->MO.

Russ: I agree about missing it…

The big difference with the above method is that you need to churn the credit line monthly….back in the AOR days you just “set it and forget it.”