Robert:

Amex has been ratcheting up the complexity on their offers and benefits. Partially due to covid, wanting to retain customers, and wanting to maintain and build engagement. The gamification of Amex is in full swing.

Sam:

These credits are not free money, and they’re definitely not always easy as we’ll discuss today…

For each of these let’s discuss:

- The Promise

- The Problems

- Possible solutions

1:39 Amex Offers: Slow Posting

- Early February credits, across the board/on a number of fronts, were very slow to post

- TPG: “Here’s why you shouldn’t worry” (link)

- Response: Here’s why slow posting credits are worrisome…

- The T&Cs are convoluted, lengthy and full of gotchas. Ex: Home Depot off that was only online (who normally shops at Home Depot online?) and GCs are processed through a 3rd party

- When credits don’t post quickly (when they otherwise have tended to historically) it creates confusion whether fine print was missed.

- All this said: Things seem to have improved more recently across the board after a miserable early Feb stretch.

8:40 PayPal $30/mo on Amex Personal Platinum Through June 2021

- T&Cs

- Early Feb Hiccup– What to do when credits don’t post?

- P2P vs merchants

- GC reselling angle?

- Potential Clawbacks for returns

- Seems stackable with things like Saks

13:00 Uber Credits

- T&Cs

- $15/mo for Personal Platinum

- $10/mo credit for Personal Gold

- Combining credits from multiple cards (spousal/friends as well)

- Velocity limits when adding cards

- Moving cards from one Uber account to another

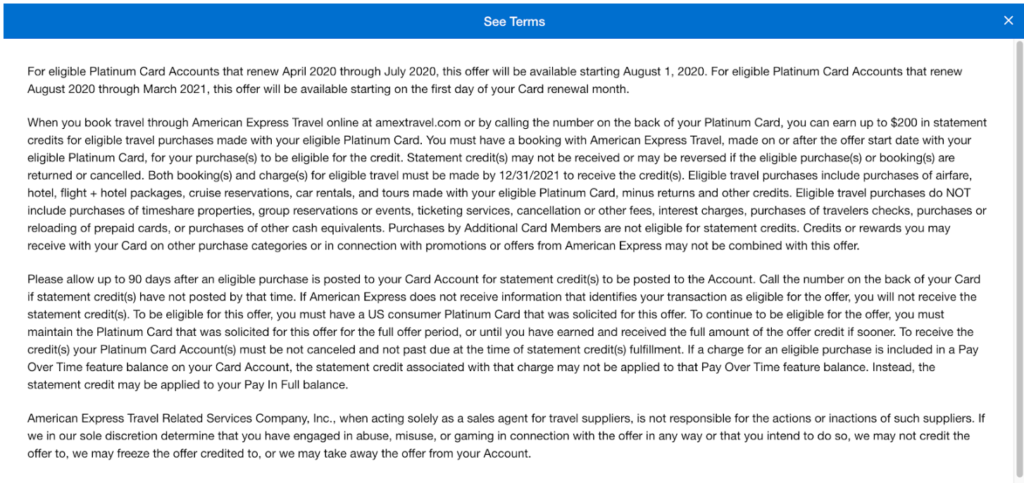

18:31 [Targeted] $200 Amex Travel Platinum Offer Exploration

- We’ve been talking about this a lot lately

- Robert posted the T&C last week (Which don’t show anywhere online)

- The pages describing this online make it sound like it is offered to all–and not targeted.

- I set out to test that this week.

- So I booked a $210 ticket on Amex Travel with my recently renewed Platinum.

- Nothing happened. (Smoke)

- So I chatted and pointed Amex to the TPG article (link which points to a DoC article that refers back to a rumor article from DoC)

- The missing T&Cs (only visible to those targeted)

24:29 Ongoing Credits

- Keep in mind this all is on top of…

- Dell Credits on Biz Plat

- Saks Credits on Personal Plat

- Airline Travel Credits

- Dining credits on co-branded personal cards

- Wireless credits on co-branded business cards

- Discuss: Do we work for Amex?

Robert: “Thanks for joining us for this week. For a more in-depth discussion about points miles visit us at patreon.com/milenomics. There you’ll get a special link to listen to additional content, right in your mobile podcast app or on your computer, where we speak more freely about topics like these.

Sam: You can reach us on Twitter @Milenomics and @RobertDwyer – we’d love to hear from you. Until then we’ll see you on the site…”

I canceled my Platinum card yesterday. No retention offer this year because I received $200 last year. Had enough of their drama.

Appreciate the comment Al. I was in a similar boat, Renewed in Jan and I was given a retention last year at renewal. I decided to keep the card and roll the dice on a retention offer 13 months after last year’s (that seems to be the threshold for another offer). It meant I was locked in for another year and was a gamble. Fortunately it seemed to pay off as just last week I was given 30k MR with no spend. But this means I’m stuck paying an AF next year because I will have to hold through the annual fee. So I’m still on the merry-go-round and you’re off it, which I’m a bit envious of.

I’m not clear…you were given 30k MRs without asking for them or you called in after already committing for another year? And why must you renew next year? Are the 30k MR conditional on you renewing? I had the $200 Amex travel offer, so maybe I should’ve renewed, but I figure I can get the Schwab Platinum when it’s time to actually travel again or hope for a Platinum offer without the once in a lifetime language. I canceled on the 30th day after AF posted, so I got some March credits.

Al: Sorry about the confusion. My Annual Fee hit in January–and last January I took a retention offer. I had to wait out the 13 months from that–which pushed me into late Feb before I could ask for a retention offer–well past the window to cancel and receive my AF refund.

As part of chatting and taking the 30k offer I agreed to keep the card open for 12 months– so into March 2022. Was that worth it…. maybe? But that means next January when the AF hits again I can’t close the card.

I’m with you–getting out would allow a sign up bonus on a new card which is much greater than the 30K. I’m in this card for another year and another big AF… so I don’t know if taking the offer was the best move.

For the $200 Amex Travel Platinum Offer I’ve received an email on this stating that I have the benefit – and I believe if you go to this link: https://www.americanexpress.com/en-us/travel/benefits/how-to-use-travel-credit/ and login, it will determine your eligibility.