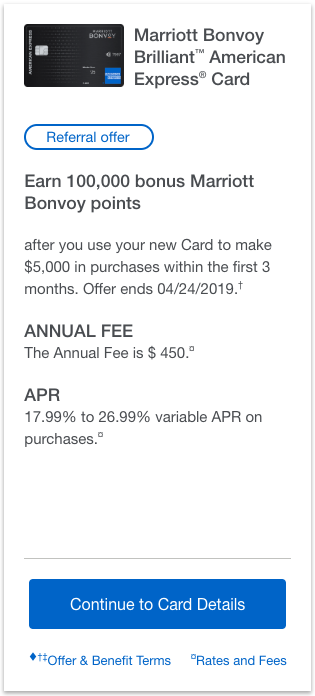

The Amex Marriott Bonvoy Brilliant card with a 100,000 point signup bonus is now available for referrals.

The Amex Marriott Bonvoy Brilliant card with a 100,000 point signup bonus is now available for referrals.

The $450 annual fee is not waived the first year, but the card comes with a $300 per cardmember year statement credit for Marriott hotels.

Eligibility

The list of disqualifying dispositions is a long and painful read. But if you have or had the most common Marriott/SPG cards, this may be the one card you’re still eligible for:

Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Welcome offer not available to applicants who (i) have or have had The Ritz-Carlton™ Credit Card from JPMorgan or the J.P. Morgan Ritz-Carlton Rewards® Credit Card in the last 30 days, (ii) have acquired the Marriott Bonvoy Boundless™ from Chase, the Marriott Rewards®Premier Plus Credit Card from Chase, the Marriott Bonvoy™ Premier from Chase, the Marriott Rewards® Premier Credit Card from Chase, the Marriott Bonvoy™ Premier Business from Chase or the Marriott Rewards® Premier Plus Business Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus or upgrade offer for the Marriott Bonvoy Boundless™ from Chase, Marriott Rewards®Premier Plus Credit Card from Chase, the Marriott Bonvoy™ Premier from Chase, the Marriott Rewards® Premier Credit Card from Chase, the Marriott Bonvoy™ Premier Plus Business from Chase or the Marriott Rewards® Premier Plus Business Credit Card from Chase in the last 24 months.

Keep in mind that Amex has also been limiting many to 5 active credit cards. This counts personal and business credit cards, but doesn’t count charge cards nor cards you’re an authorized user on.

Amex Bonvoy Brilliant 100,000 (+ 20,000): How to Play It

If you want to get any Amex card, you should refer your spouse or trade referral links with a friend.

By referring, you’ll earn up to 20,000 Membership Rewards (depending on the cards you currently have) since Amex determines the referral bonus based on the card you’re referring from rather than the card you’re referring to. You don’t even need to have an Amex Bonvoy card in order to refer for it.

Listen: Episode 10: Why You Should [Almost] Never Apply For An Amex Card Using Someone Else’s Link

See: Why And How: Generating And Using An Amex Referral

If by chance you don’t have any Amex cards yet, or you don’t have an Amex card that can refer for this Bonvoy Brilliant card you could use my referral link to get started (my thanks in advance if you choose to use it):

Amex Marriott Bonvoy Brilliant 100,000 Referral Link (now 75,000)

If you’re unsure of how to prioritize your Amex signups this episode of the podcast would be a good to one to listen to:

Listen: Episode 13 & 14: A Deep Dive Into American Express 5 Card Strategies

Bottom Line

The Amex Hilton Aspire is a better card. We detail why that is in the latest episode of the Paid version of our podcast.

But if Marriott points (or the airline miles these can be converted to 60,000 to 25,000) are useful to you and you have/had most of the Marriott/SPG/Ritz-Carlton cards this may be your only remaining option.

I don’t think it’s a keeper the second year, but we’ll see how hard it is to reliably get $150+ of value out of the “free night” certificate for hotels costing up to 50,000 points a night. Expiring certificates can be a bit of a nuisance.

I’m going to refer my wife for it.