We’ve been pointing out for over a year now that the Chase Ultimate Rewards portal has a tendency to show Vacation Rentals that are available for booking on Expedia proper as “Sold Out” in the Chase poral.

See: Chase UR Travel Portal Sold [Us] Out–New Expedia Powered Portal Issues

This has diminished my ability to redeem Ultimate Rewards for 1.5 cents a piece of uplift with the Chase Sapphire Reserve, which deflates the value proposition of living the bank point lifestyle. But what bothered me even more was that when I went to pay for a VRBO booking on my Chase Sapphire Reserve it coded as 1x rather than 3x for travel as I’d hoped.

Does VRBO code as travel on Chase credit cards? It didn’t for me.

After resigning myself to not using bank points to pay for this booking, I thought about which credit card I should put the charge on.

As we were discussing on Episode 47 of the podcast – Amex recently announced they’d be changing their ancillary benefits related to trip cancellation and travel interruption. That, combined with the fact that I was working on min spend on an Amex card had me thinking about putting the charge on an Amex card. But since travel only earns 1x on the Amex card I was working towards min spend on I decided against it. Besides, I was unsure when the Amex benefits kicked in and travel insurance can be a squirrely thing.

See: Using Chase Sapphire Reserve Travel Insurance Benefits In Real Life

I did a Google search for whether VRBO coded as 3x on Chase cards and found this article on TPG:

The Points Guy: Earn Bonus Ultimate Rewards Points: VRBO Home Rentals Now Code as Travel

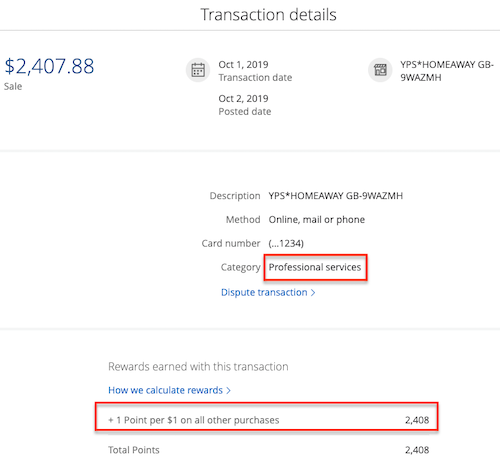

Especially since The Points Guy is a prominent Chase affiliate I thought this was sound assurance that my purchase would earn 3x. So I put the charge on my Chase Sapphire Reserve. And when it posted it coded as…only 1x rather than the 3x I’d hoped for. 🙁

This was the second time in the past month I’ve gotten faulty information from TPG. The first was how Marriott Bonvoy stopped charging extra person fees when they didn’t actually stop charging extra person fees. Now this.

If it doesn’t, patch it up by calling

I was just going to let it go, but it didn’t feel right to me that a card like the Chase Sapphire Reserve that’s broadly supposed to earn 3x only earned 1x for a VRBO booking. And I was mildly concerned that since it didn’t code as travel that I’d have a hard time if/when it came to filing a travel insurance claim if our trip was interrupted.

And further, it was above my “$20 rule” whereby I absolve myself of chasing merchants who have wronged me in small ways.

So I called Chase and they quickly patched it up, crediting my account with 2x extra Ultimate Rewards for a total of 4,816 Ultimate Rewards. That was nice of them, but I realized that this didn’t trigger the $300 annual travel credit benefit the card comes with so I still have to slog through that with other transactions.

Does it matter? Not really. But still…

I said on Episode 45 of the podcast that:

There’s a *huge* difference between “which credit card reward program is best for redeeming towards some kind of travel” vs “which credit cards are the most rewarding when paying for travel.” Huge. Don’t fall for it.

I consistently read articles about using credit card rewards to pay for big ticket items like cruises that quickly pivot into discussing which credit card you should use to pay for a big ticket item. It’s frustrating when you came to read about a high leverage proposition like using bank points to pay for a cruise like a Disney Cruise with Citi ThankYou Points then end up getting mostly a bunch of links for credit cards.

My point is: You’re far better off figuring out how to maximize a rewards program than concerning yourself with whether a transaction earns 1x or 5x – even on a big ticket item. One is a discount on the order of 60+% where the latter is on the order of 5-10%. When that’s the case: Focus on the 60+%.

All that said: I’d rather have 3x on the Sapphire Reserve than 1x, so if Chase codes your vacation rental as 1x give them a call.

And Chase, if you’re reading this: Fix your Vacation Rentals through the portal. It’s a very annoying part of your value proposition.

You are luckier than we were. I had read the same article and therefore, put my VRBO rental payment on my CSP, presuming it would code as travel. When it did not, I too contacted Chase but was still denied the additional points or having the payment changed to code as travel. Now when the other VRBO payments come due I am uncertain which card to put them on. I hope Chase does rectify this situation.

That’s disappointing on a number of levels, Susan.

I’m sorry that happened to you. Really lousy of Chase not to patch this up when it hasn’t coded properly.

This just happened to me, except I used CIP. I sent Chase a SM about re-coding as travel. Fingers crossed, but not hopeful.

Just went through the same thing. I put my VRBO on my CSR and it coded as professional services. I called Chase and they said they do not have control over what the merchant codes as, but they would give me a 1-time courtesy credit and I ended up getting my 3x points.

Not sure if this comment will be seen since this article was a while ago but I was searching to see if this was a problem for others and ran across this. To add my experience…

I’ve been having a problem with this since I opened our CSR account. I did my homework and BEFORE I switched to CSR, I had several questions – including whether or not VRBO and Airbnb charges would qualify for triple reward travel points and I was told that they would. The first time I noticed I didn’t receive the triple points, I sent a message and the points were adjusted and I believe I was told that there was no automatic way for the adjustment but that I could make the requests when I see the problem (unfortunately these older messages are no longer available). Recently I checked my points again and sure enough, I had more VRBO charges that received single points so I sent another message. I was told that “as a one time courtesy” the points would be adjusted and that future charges would NOT qualify for triple points – and that Chase has no control over the merchant categories. I then had a couple of exchanges with Chase reminding them that I had asked about this specific issue before opening my account with them and that I felt I had been mislead. The last message I received says, among other things, “We responded to this request earlier. Because there is no further action required on the account, we will no longer respond to this specific inquiry.” Wow – at this point I’m really irritated and tempted to switch to another card. I find Chase’s response unacceptable.

Oh, and I’m saving copies of all messages now since they will get deleted after a while.

I think you should really consider the value of this card moving forward. Especially with the AF increase–is the 3x worth it even if it were to post correctly?