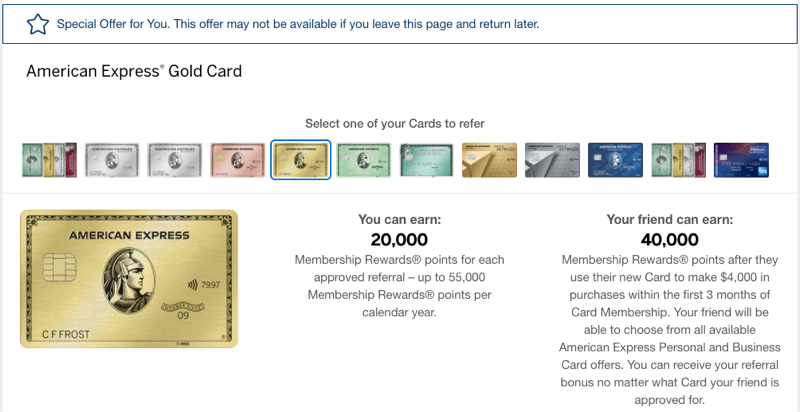

We’ve been seeing [targeted] heightened 20,000 Membership Reward “Blue Star” referrals come and go on Amex Business Platinum and Personal Gold cards. Right now they seem to be “in season” with a high percentage of these cards showing heightened referral bonuses.

Update: Others are reporting seeing this one Personal Platinum and Business Gold as well.

In this write-up and Milenomics Short Cut podcast episode, we’ll cover how how to maximize this referral opportunity.

If you’re new to Amex referrals, have a look this post:

Generating and Using an Amex Referral

To check whether you’re targeted, go here and click through each of your cards especially the Business Platinum and Personal Gold cards:

Here are the topics we went over:

You can refer a wide variety of Amex cards from either of these cards

Don’t think you’re limited to referring for just these two cards. With Amex universal referral, your friend can sign up for a wide variety of Amex Membership Reward cards, plus co-branded cards like Hilton and Delta.

With Amex the referral bonus is based on the card you refer from

Regardless of which card your friend signs up for, the referral bonus is based on the card you refer from. That’s pretty unusual if you think about it. Amex has high signup bonuses for their flagship cards with high annual fees. But referrals are based on which card you refer from. This means your friend can sign up for a lowly no annual fee card, and you can still get 20,000 Membership Rewards if the card you’re referring from has been targeted.

These 20,000 Membership Reward Referrals are Targeted

Some people are targeted and some are not. Some cards are targeted and some are not. You can have two of the exact same card and you may see one targeted with 20,000 point referral capacity and the other card remains at 10,000 points. It even varies from day to day. If you see this offer, you may want to pounce on it. But you don’t necessarily need to use it immediately. More on that below. They can be “squirreled away.”

We’ve heard that some people are temporarily blocked from generating Amex referrals. We call this a “penalty box” which is usually a timeout that heals itself after time, but it’s unclear what causes it and how to get out of it.

The welcome bonuses are often better (on some cards) if you go incognito

“Going incognito” to see better offers (or at least different offers) is definitely a thing. Amex is notorious for displaying different welcome bonuses depending on how “come at them.”

Take for example the 40,000 point welcome bonus associated with the Amex Personal Gold card in the image at the top of this post. When I click through that referral link I sometimes see 40,000 and other times I see 50,000.

First, compare notes with others on what the best current bonus is for a given card. Then try to get that offer to come up. You can check desktop or mobile. Chrome or Firefox. Try going incognito/private. Try connecting to a VPN in another part of the country. Any of these can cause the welcome bonus to change. Crazy, right?

In some cases, referral welcome bonuses are worse than public non-referral offers

It stinks when a bank makes a referral offer worse than a public offer. It happens from time to time, but I don’t think it’s necessarily malice on their part. Offers through various channels just vary, or in some cases lag one another.

For example, we recently saw a 100,000 point public welcome offer on the Bonvoy Brilliant card. The referral offer stayed at 75,000 points however, and it never caught up with the heightened public offers. It’s unfortunate when that happens, but what can you do besides wait until a heightened referral coincides with an all-time high welcome bonus?

If your spouse is at Amex’s 5 credit card limit, consider going for a charge card instead

Amex issues credit cards and charge cards. They generally have a limit of 5 active credit cards per person. This includes personal and business cards. Being an authorized user does not count towards this limit.

Charge cards are counted separately, so look at using a referral towards a charge card if you’re bumping up against the 5 card limit.

You can get the referral bonus even if your friend has already gotten the welcome bonus for a card

In some cases it could make sense to refer for a card your friend has had before, even though they’ve had the card before and won’t get the welcome bonus. They just need to be approved in order for you to get the referral bonus.

Charge cards with the annual fee waived the first year like the Business Green card is an example of this.

The Personal Gold card could make sense, even without a welcome bonus and with its annual fee, for increased 4x capacity at grocery.

Don’t self-refer. Swap referrals with a friend if needed.

This has been a cause for clawback and even shutdown from Amex. Don’t do it.

Instead, refer your spouse or swap referrals with a friend.

It’s worth noting that being an authorized user of a card doesn’t disqualify you from getting a welcome bonus yourself.

There is still a 55,000 per card (you’re referring from), per year, referral bonus cap

So effectively you’ll only get the full 20,000 per referral, per card, twice. The 3rd referral would earn just 15,000 which is better than the 10,000 points the Personal Gold earns for referrals currrently but still: If you’ve got this on multiple cards you’ll want to use two referral per eligible card first.

Referral bonuses are taxable

Unlike welcome bonuses, referral bonuses are taxable. Membership Rewards are valued at a penny a piece when Amex sends out 1099s, which you should expect to get for $600 in referrals in a calendar year. Even if you don’t get a 1099 you should include referral bonuses when filing your taxes.

Squirrel referrals away for later use

Since the ability to refer comes and goes, you may want to save referral for later use by emailing one per eligible card to yourself for later use.

You can even “redirect” one of these you’ve saved to someone else, but be aware you’ll need to know the email address of the person the referral was originally intended for, and approval confirmation will go to that email address as well. This can be overcome, but it’s worth mentioning if you’re thinking of sharing referrals with a stranger.

Bottom Line

All in all, the Amex referral program is still the best out there. With it, we’re all affiliates.

Welcome bonuses for Amex cards are a bit low overall right now so it’s probably a good time to pick up “lesser”/more obscure cards. For example, the Everyday/Everyday Preferred, Personal/Business Green, Blue Business Plus/Cash cards become compelling because 20,000 Membership Rewards for referring + the welcome bonus can make an otherwise mediocre offer compelling.

Want more podcast content?

These “Short Cuts” are very short segments compared to our full paid shows.

Check out Episode 72 of our paid podcast where we discuss:

- Heightened credit card signup bonuses

- A peculiar new way to rack up credit card spend from home

- Booking in uncertain times

Or subscribe to the No Annual Fee Edition

Subscribe below to the Free, No Annual Fee Milenomics² podcast on Apple Podcasts:

Or on Google Play Music:

And NOW also on Spotify: